nj employer payroll tax calculator

How Your New Jersey Paycheck Works. New Jersey Gross Income Tax The.

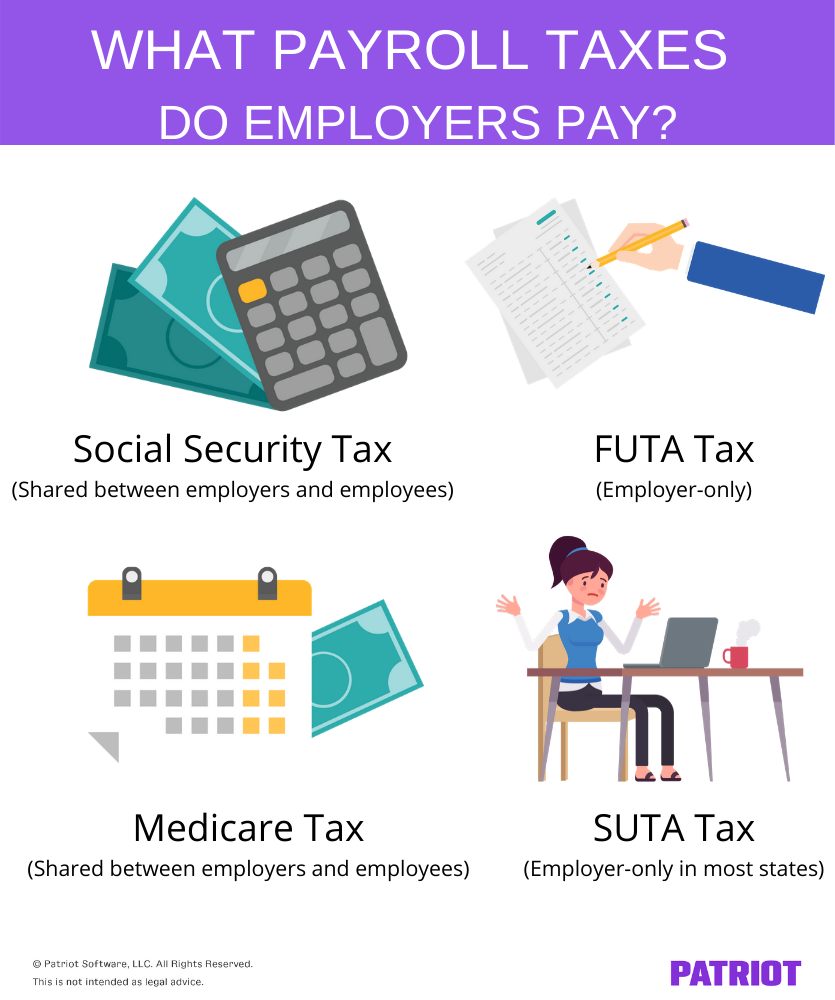

What Are Employer Taxes And Employee Taxes Gusto

A Notice To Employers - Electronic Filing Mandate for Employer Year-End Filings and Statements.

. Employer Payroll Tax Electronic Filing and Reporting Options Employers must be registered with the State of New Jersey for payroll tax purposes to file Forms NJ-927 NJ-W-3. Rates range from 05 to 58 on the first 39800 for 2022. The effective rate per hour for 2022 is 1300 effective 01012021.

Your employer uses the information that you provided on your W-4 form to. Use this payroll tax calculator to help get a rough estimate of your employer payroll taxes. 0425 New Jersey new employer rate.

Click to read more on New Jerseys minimum wage increase. If youre a new employer youll pay a flat rate of 28. Our employer tax calculator quickly gives you a clearer picture of all the payroll taxes youll owe when bringing on a new employee.

The calculator includes options for estimating Federal Social Security and Medicare Tax. Below is an explanation of how rates are calculated and a listing of the new employer rates for the current and the previous four years. Just enter the wages tax withholdings and other information required.

Federal income taxes are also withheld from each of your paychecks. 05 to 58 for 2022 New Jersey SUI employee rate. Use Gustos salary paycheck calculator to determine withholdings and calculate take-home pay for your salaried employees in New Jersey.

Both employers and employees contribute. 28 for 2022 New Jersey new employer rate. New Jersey SUI employer rates range from.

New Jersey Hourly Paycheck Calculator Change state Take home pay is calculated based on up to six different hourly pay rates that you enter along with the pertinent federal state and local. Withhold 62 of each employees taxable wages until they earn gross pay. How we calculate rates Base weeks NJ-927 and WR-30.

Annual Reconciliation Of Gross Income Tax Withheld From. Select a State Annual Wage. Expenses that may be deducted in New Jersey include certain unreimbursed medical expenses New Jersey property taxes Archer MSA contributions and if youre self.

Use ADPs New Jersey Paycheck Calculator to estimate net or take home pay for either hourly or salaried employees. It simply refers to the Medicare and Social Security taxes employees and employers have to pay. Calculate your New Jersey net pay or take home pay by entering your per-period or annual salary along with the pertinent federal state and local W4 information into this free New Jersey.

Well do the math for youall you need to do is.

Free Employer Payroll Calculator And 2022 Tax Rates Onpay

Payroll Tax Calculator For Employers Gusto

Treasury Launches Automated Annual Payroll Tax Filings For Employers Roi Nj

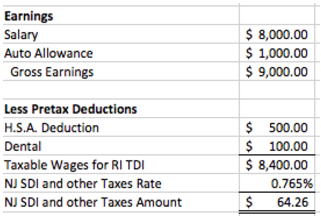

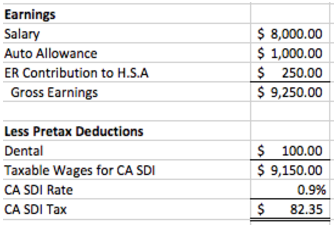

How Are State Disability Insurance Sdi Payroll Taxes Calculated

The True Cost Of Hiring An Employee A Guide To Employer Payroll Taxes Sharp Payroll Service

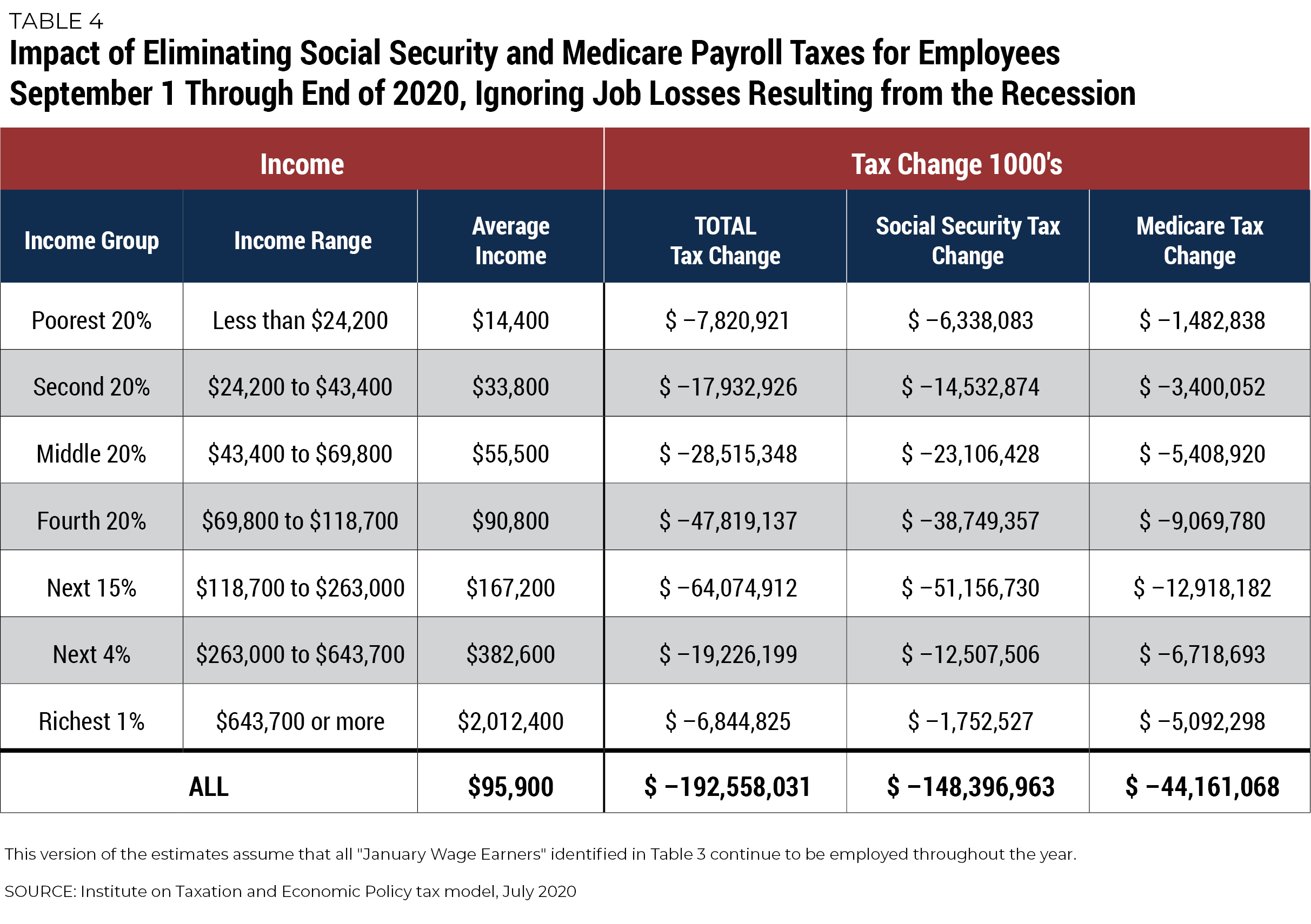

An Updated Analysis Of A Potential Payroll Tax Holiday Itep

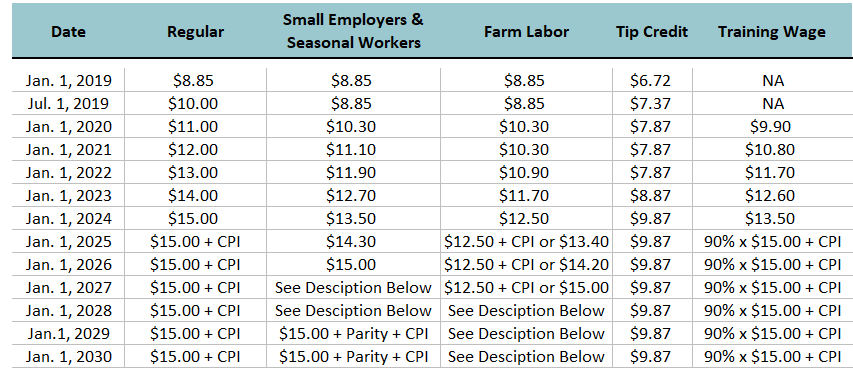

Minimum Wage Law P L 2019 C 32 Njbia

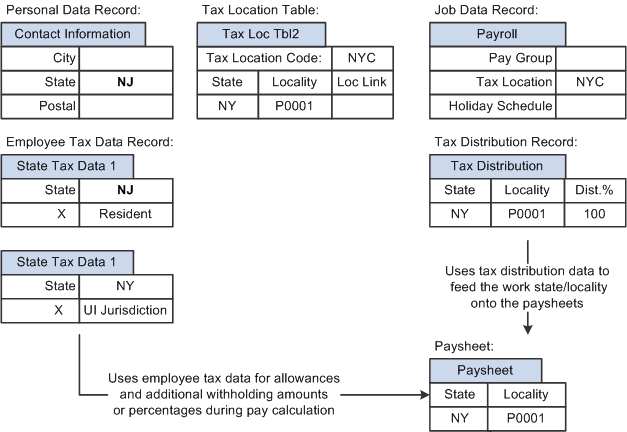

Peoplesoft Payroll For North America 9 1 Peoplebook

Payroll Taxes Paid By Employer Overview Of Employer Liabilities

New Jersey Nanny And Payroll Taxes Nanny Tax Tools

New Jersey Paycheck Calculator Smartasset

Nj Division Of Taxation Employer Payroll Tax

How Are State Disability Insurance Sdi Payroll Taxes Calculated

Division Of Unemployment Insurance Faq Paying Federal Income Tax On Your Unemployment Insurance Benefits

New Jersey Paycheck Calculator Smartasset

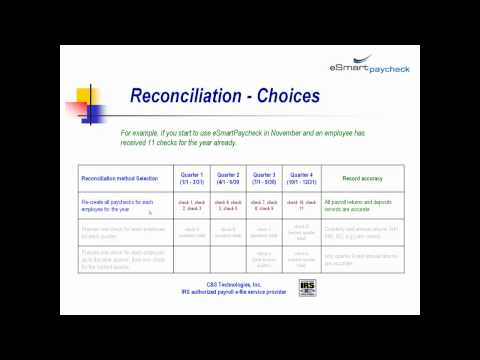

Esmart Paycheck Calculator Free Payroll Tax Calculator 2022